Home

Build the Foundation For Your Future

At Grady College, we’re preparing the next generation of communications leaders. Your story starts here.

Degrees

Explore our undergraduate and graduate degree programs at Grady College.

-

Advertising

Advertising

Thrive with creative, versatile skills in traditional and new media that are instrumental in shaping future industry leaders.

Entertainment & Media StudiesEntertainment & Media Studies

Innovate through skills and conceptual courses for careers in film and television entertainment.

JournalismJournalism

Serve industries and communities through audio, visual and written storytelling in the digital media world.

Public RelationsPublic Relations

Learn from top professors in what PRWeek calls one of the top five Outstanding Education Programs in the country.

-

M.A. Degree

M.A. Degree

Get advanced preparation for careers in advertising, journalism, health & medical journalism, public relations and more.

M.F.A in Film, Television & Digital MediaM.F.A in Film, Television & Digital Media

Answer the call of one of the state’s largest industries through a two-year program starting in Athens at Athena Studios, and finishing at the Georgia Film Academy at Trilith Studios.

Low-Residency M.F.A. in Narrative Media WritingLow-Residency M.F.A. in Narrative Media Writing

Write a publishable nonfiction manuscript or a marketable screenplay in two years in this low-residency MFA program.

Ph.D. Degree ProgramPh.D. Degree Program

Designed to prepare scholars for academic careers in teaching and research or for professional careers in industry or government.

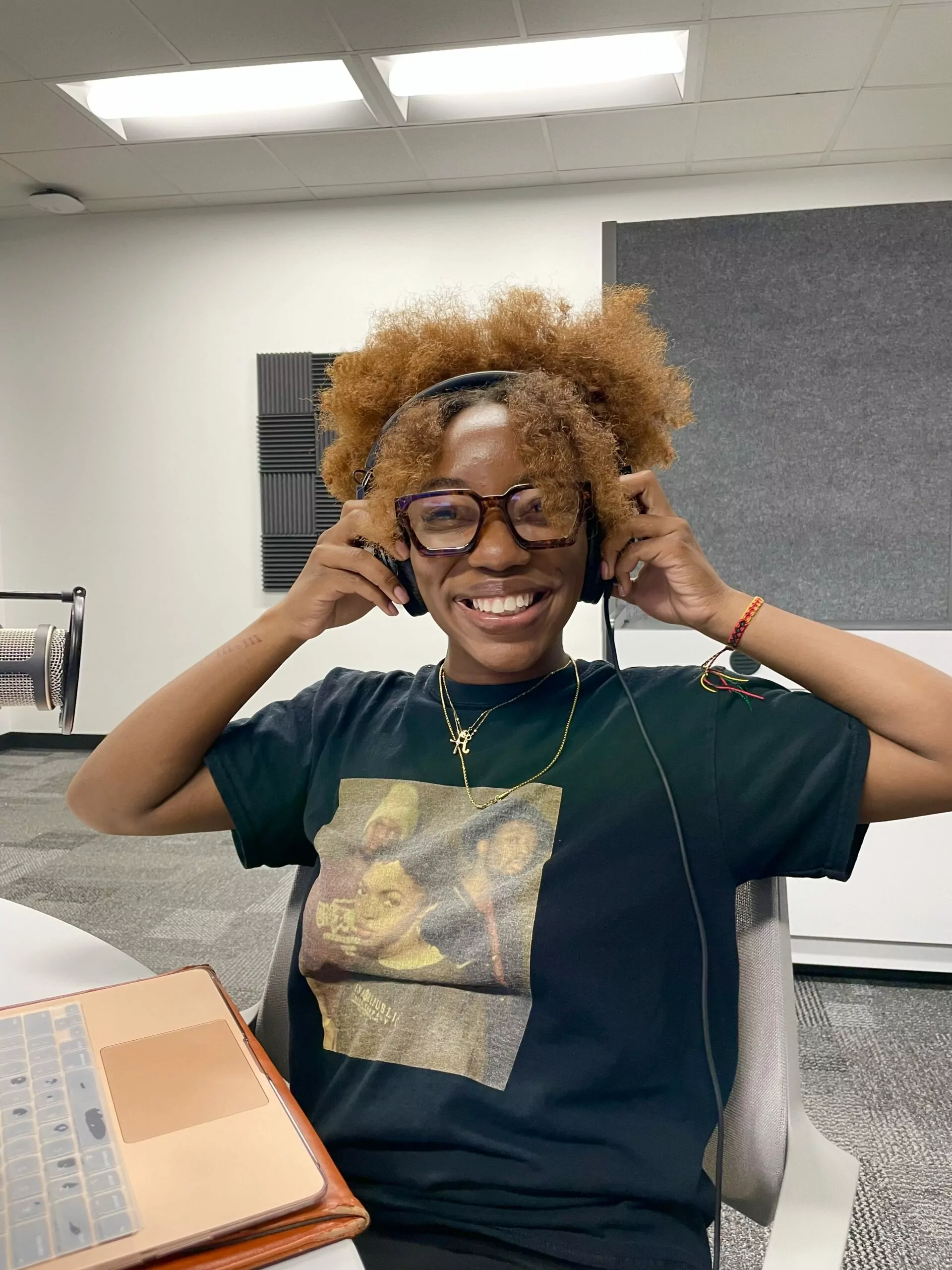

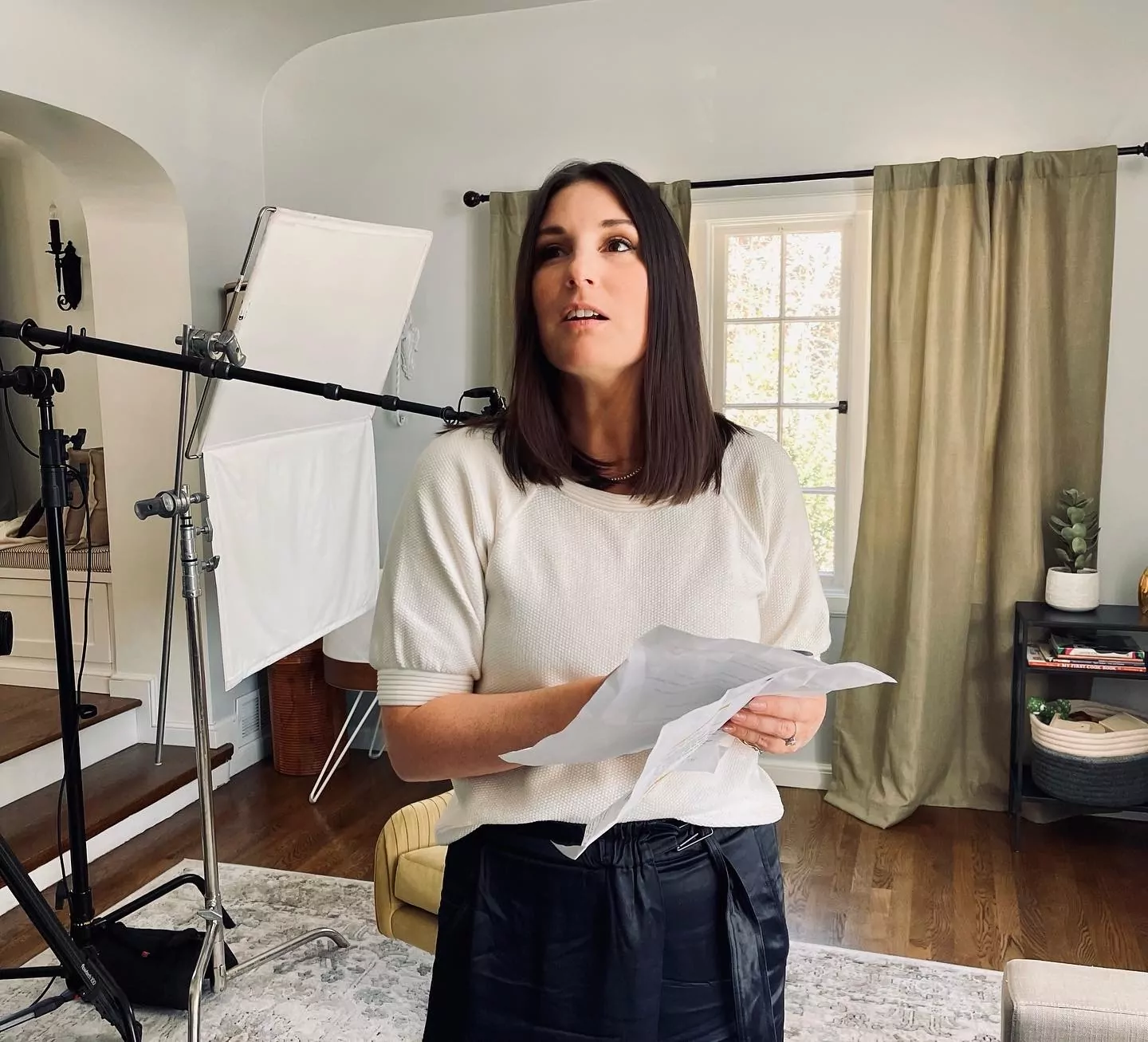

Stories Are CREATED Here

Check out our student, faculty, staff and alumni spotlights.

Get to Know Grady College

The University of Georgia draws its energy from Athens, a classic college city in every sense of the word. Tucked into the middle of it all is the Grady College of Journalism and Mass Communication. Led by a world-class faculty, graduates leave empowered and changed. Our degrees open doors to opportunities all over the world. The experience keeps a piece of their heart in Athens with their Grady family forever.

The Latest

Read the newest headlines, get updates and discover events happening at Grady.

Events

Home of the Peabody Awards

Since 1940, the Peabody Awards have honored the most powerful, enlightening and invigorating stories in broadcasting, streaming and interactive media—and it all started right here, at the University of Georgia.

Considered to be one of the most prestigious honors in the industry, the Peabody Awards are bestowed upon a curated collection of stories that capture society’s most important issues each year.

Centers & Institutes

Grady College is proud to be home to several centers, institutes and affiliates specializing in areas of academics and research.

The Center for Health and Risk Communication at the University of Georgia advances knowledge about the role of communication processes in enhancing human health and safety.

The Georgia Scholastic Press Association was organized in 1928 by Grady College to promote the understanding and practice of journalism among high school students.

The James M. Cox Jr. Center for International Mass Communication Training and Research (Cox International Center) is dedicated to international outreach and research in mass communication, media and journalism.

The Cox Institute prepares students for leadership roles in the news media by sponsoring intensive training programs and funding applied research to address strategic challenges.

The Carmical Sports Media Institute at the University of Georgia offers the Southeastern Conference’s first dedicated program of study for undergraduates interested in sports reporting and writing, broadcasting, social and digital media and media relations and communication.

Headquartered at Grady College, the NPPA is the leading voice advocating for the work of visual journalists today. The NPPA is dedicated to promoting visual journalism’s role as a vital public service. We fight for working news photographers, videographers and multimedia journalists.

The New Media Institute (NMI) is an interdisciplinary academic unit dedicated to exploring the critical, commercial and creative dimensions of emerging technologies. The NMI houses the University of Georgia’s largest certificate program for undergraduates, as well as residential and online Emerging Master’s degree programs among other offerings.

Apply now

Join the next generation of communication leaders. Your story starts here.